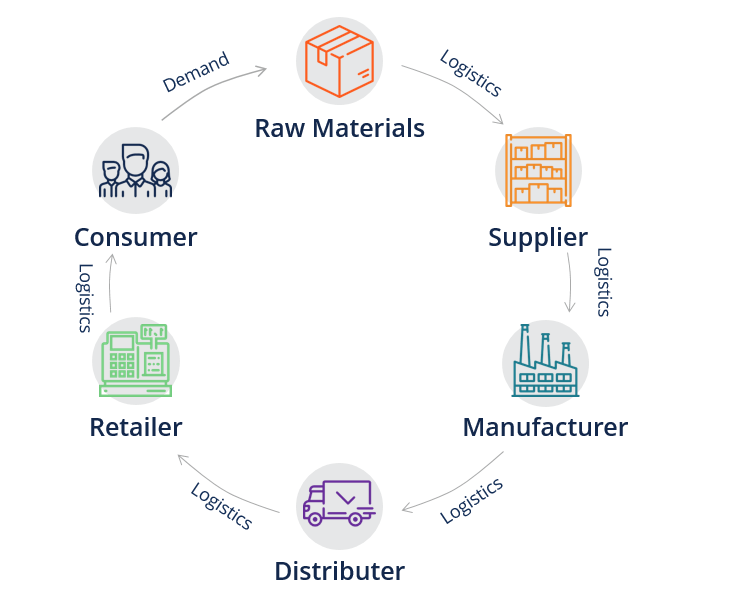

Supply chain activities involve the transformation of natural resources raw materials and components into a finished product that is delivered to the end customer.

Supply chain finance definition.

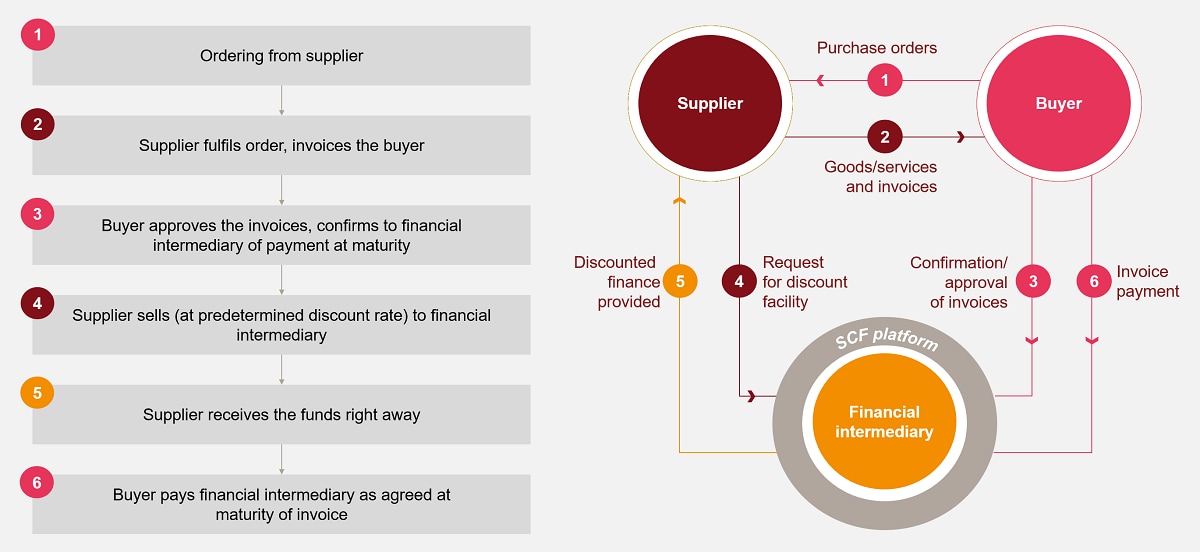

Supply chain finance also known as supplier finance or reverse factoring is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and sme suppliers to get paid early.

The following definition of supply chain finance is intended to be used for reference throughout this document and is recommended as the master definition for supply chain finance.

Additionally a 2017 icc survey of banks in 98 different countries identified scf as the most important area for development and strategic.

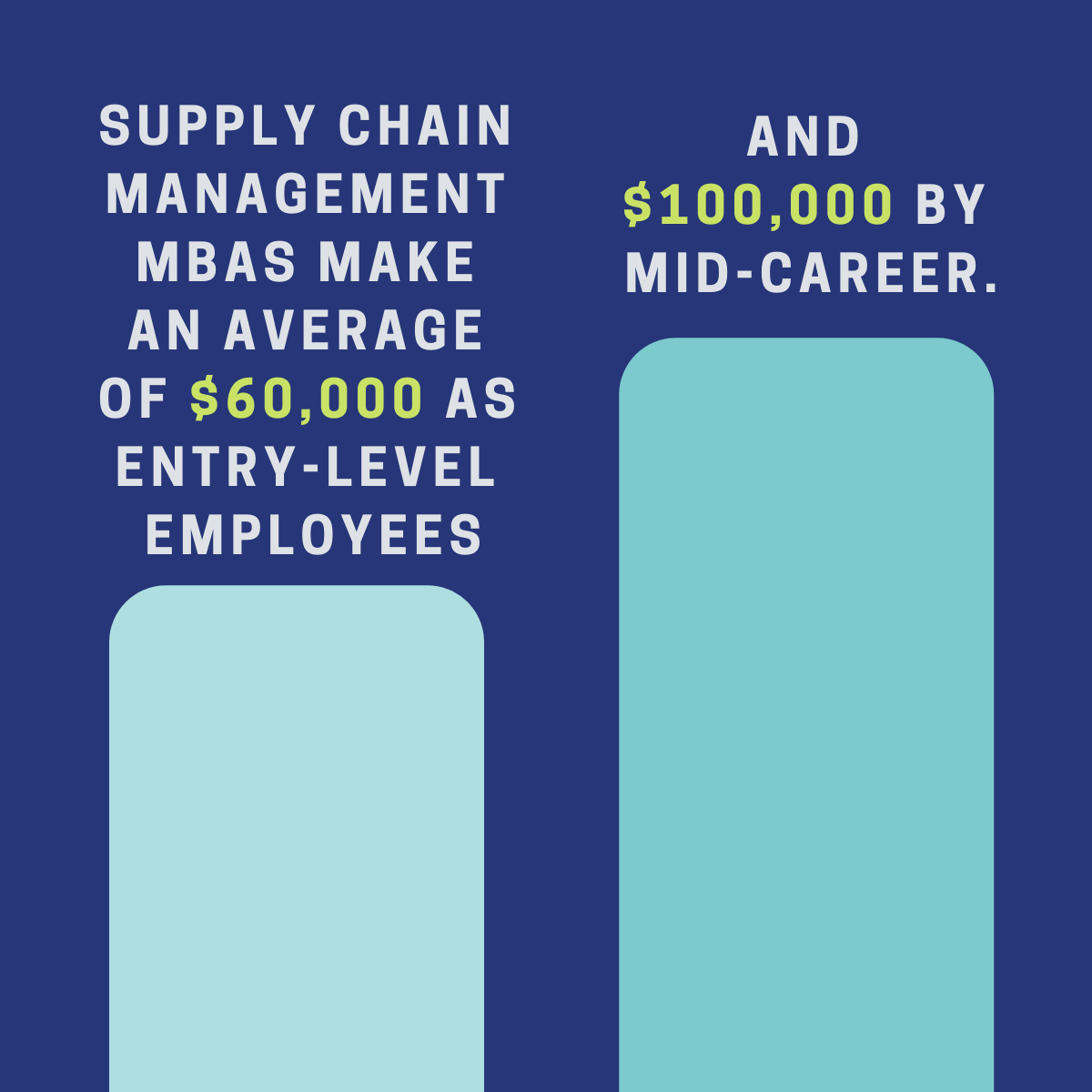

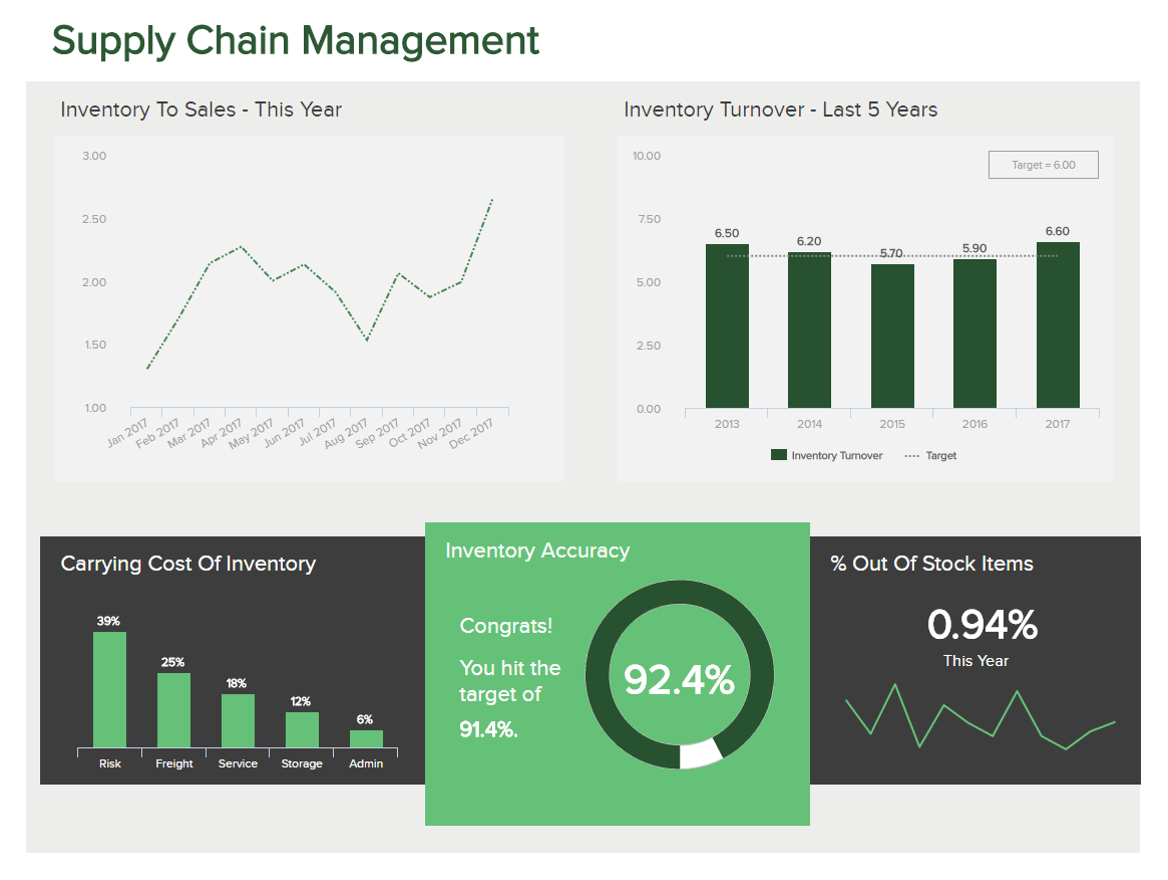

Supply chain management results in lower costs and a faster.

In commerce a supply chain is a system of organizations people activities information and resources involved in supplying a product or service to a consumer.

Supply chain finance is a set of technology enabled business and financial processes that provides flexible payment options for a buyer such as a manufacturer or retailer and one of their suppliers for example a raw materials or inventory supplier typically through the services of a financial institution at lower financing costs.

Suppliers get paid early and buyers can extend their payment terms.

This results in a win win situation for the buyer and supplier.

Unlike traditional factoring where a supplier wants to finance its receivables supply chain financing or reverse factoring is a financing method initiated by the ordering party the customer in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offered in 2011 the reverse factoring market was still very small.

In 2015 a mckinsey report suggested that scf had a potential global revenue pool of 20 billion while in 2017 china s supply chain finance sector was tipped to reach us 2 27 trillion by 2020.

Scf is typically applied to open account trade and is triggered by supply chain events.

It is a solution designed to benefit both suppliers and buyers.

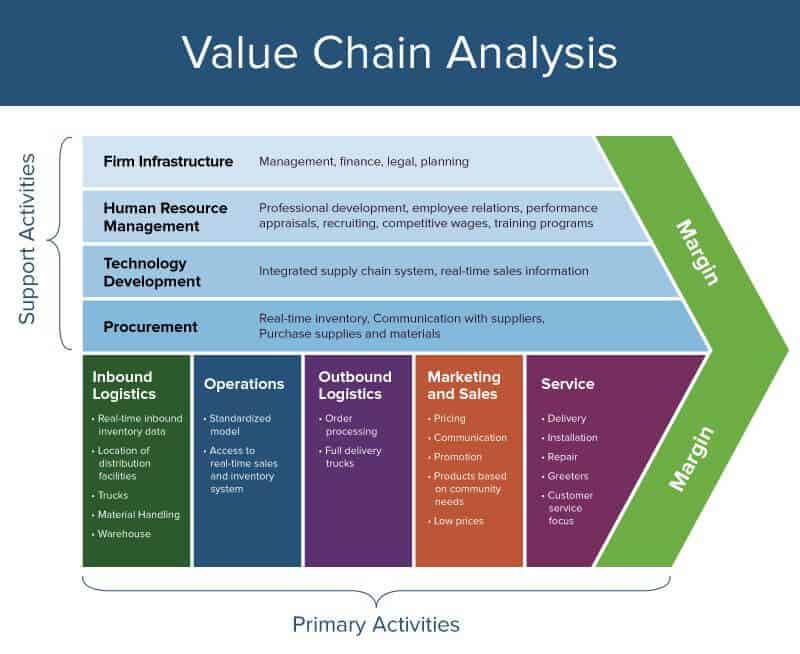

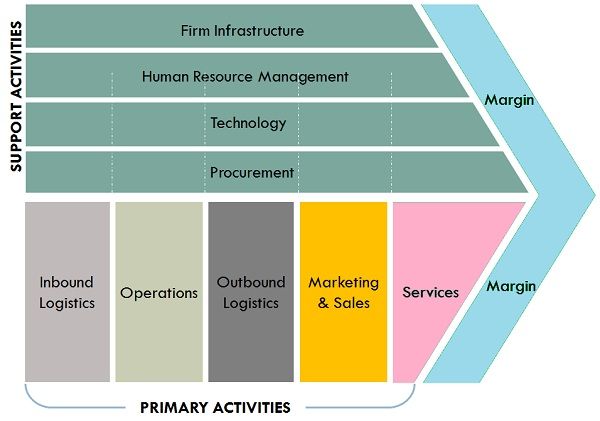

The functions in a supply chain include product development marketing operations distribution finance and customer service.

Supply chain finance is defined as the use of financing and risk mitigation practices and techniques to optimise the management of the working capital and liquidity invested in supply chain processes and transactions.

Supply chain finance is defined as the use of financing and risk mitigation practices and.

In sophisticated supply chain systems used products may re enter.

/2048px-Porter_Value_Chain-78398cffb6364895b31c98549bf6f779.png)